As a small business owner, staying compliant with evolving regulations is crucial to the success and sustainability of your business. With the recent implementation of the Corporate Transparency Act (CTA), understanding your reporting requirements regarding beneficial ownership information is more important than ever. Let’s explore what this means for you and your small business.

What is the Corporate Transparency Act (CTA)?

The Corporate Transparency Act (CTA) is a federal law aimed at enhancing corporate transparency and combating financial crime, such as money laundering and terrorism financing. One of the key provisions of the CTA is the requirement for certain businesses to report information about their beneficial owners to the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of the Treasury.

Who is Affected by the CTA?

While the CTA primarily targets entities that serve as potential vehicles for illicit activities, such as shell companies, many small businesses may still fall under its reporting requirements. Generally, if your business is structured as a corporation, limited liability company (LLC), or similar entity, and you have individuals who own or control a significant ownership interest, you may be subject to reporting requirements under the CTA.

What are your Reporting Requirements?

Under the CTA, covered entities must report information about their beneficial owners to FinCEN at the time of formation or registration, as well as update this information within one year of any changes. Beneficial owners are individuals who directly or indirectly own or control a significant ownership interest in the entity, typically defined as owning 25% or more of the equity interests or having substantial control over the entity.

How Can You Ensure Compliance?

Complying with the reporting requirements of the CTA may seem daunting, but there are steps you can take to ensure compliance and avoid potential penalties:

-

Review Your Business Structure: Assess whether your business is structured as a corporation, LLC, or similar entity, and determine whether you have individuals who meet the criteria of beneficial owners under the CTA. If your business was created after 1/1/2024, you may also need to identify applicants.

-

Identify Beneficial Owners: Identify individuals who own or control a significant ownership interest in your business, including those who hold 25% or more of the equity interests or have substantial control over the entity.

-

Gather Necessary Information: Collect the required information about your beneficial owners, including their full legal names, dates of birth, addresses, and Social Security numbers or other identifying information.

-

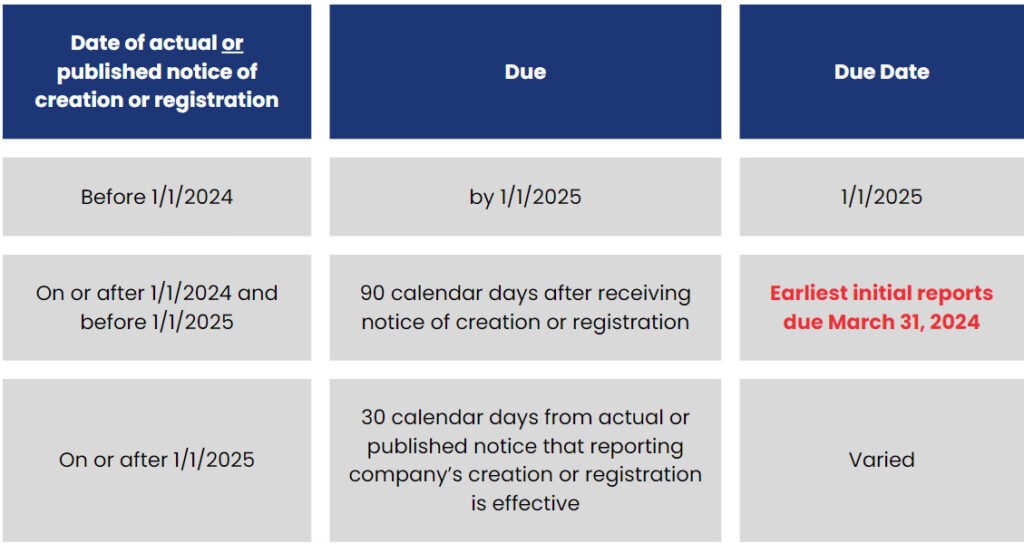

Submit Reporting to FinCEN: If your business falls under the reporting requirements of the CTA, ensure that you submit the necessary beneficial ownership information to FinCEN in a timely manner by the due dates listed below and when their are changes to the beneficial ownership or any of the information submitted to FinCEN with your initial BOI report.

If your LLC or entity was created prior to 1/1/2024, you have until 1/1/2025 to file your BOIR. If, however, your creation or registration date is on 1/1/2024 and before 1/1/2025, you have 90 days from the time that your company’s creation or registration was effective to file your initial BOI Report.

FOR EXAMPLE, if you became a reporting company on or after 1/1/2024, the deadline for your business may be as early as March 31, 2024, which assumes registration/creation effective date of 1/1/2024.

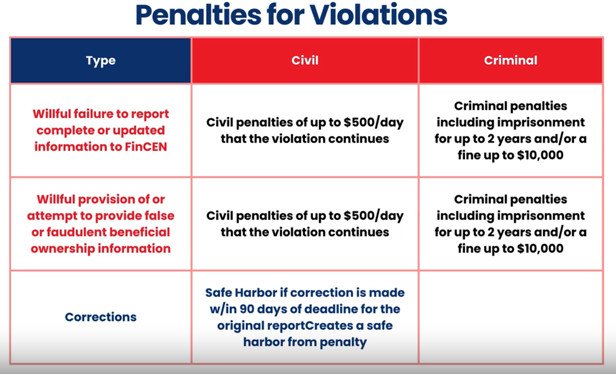

These requirements have teeth!

Consider seeking advice from legal or financial professionals to ensure compliance and avoid potential civil and criminal penalties imposed for violations of the BOIR.

Stay Informed: Stay informed about updates and developments related to the CTA and any additional guidance issued by FinCEN or other regulatory agencies. Our video provides a more detailed overview of the BOIR requirements now in effect.

Navigating the reporting requirements of the Corporate Transparency Act (CTA) may present challenges for small business owners, but understanding your obligations and taking proactive steps to comply can help protect your business and ensure its long-term success. By staying informed and seeking guidance when needed, you can navigate the complexities of beneficial ownership information reporting with confidence and peace of mind.